Vaults

What are Vaults?

Merchant Moe Vaults are an automated liquidity manager built by LFJ, called Auto-Pools. Vaults use an algorithm to rebalance liquidity in a Liquidity Book Pool, thereby removing the need to manually manage liquidity, through use of an automation solution. Liquidity Providers can therefore leverage the use of an Vault and remove the need to manually rebalance their own liquidity, helping them save time and risk of managing a manual liquidity position.

Put simply, if you do not want to manage liquidity yourself, you can deposit your assets into an Vault and let the automation rebalance Liquidity for you.

⚠️ Risk Warning

Vaults offer an automated way to access a Liquidity Book Pool. However, like all forms of providing liquidity, it's not without risks and should only be undertaken with a thorough understanding of the underlying Vault and market conditions.

Assets may experience significant divergent price movements during volatile conditions. This means your deposit is exposed to the price movements of both tokens in the pair, and your exposure to each token can also change. Volatile conditions may lead to increased impermanent/divergence loss.

Your assets may be worth less when you withdraw them compared to when you deposited them.

Your capital is at risk.

How do Vaults Work?

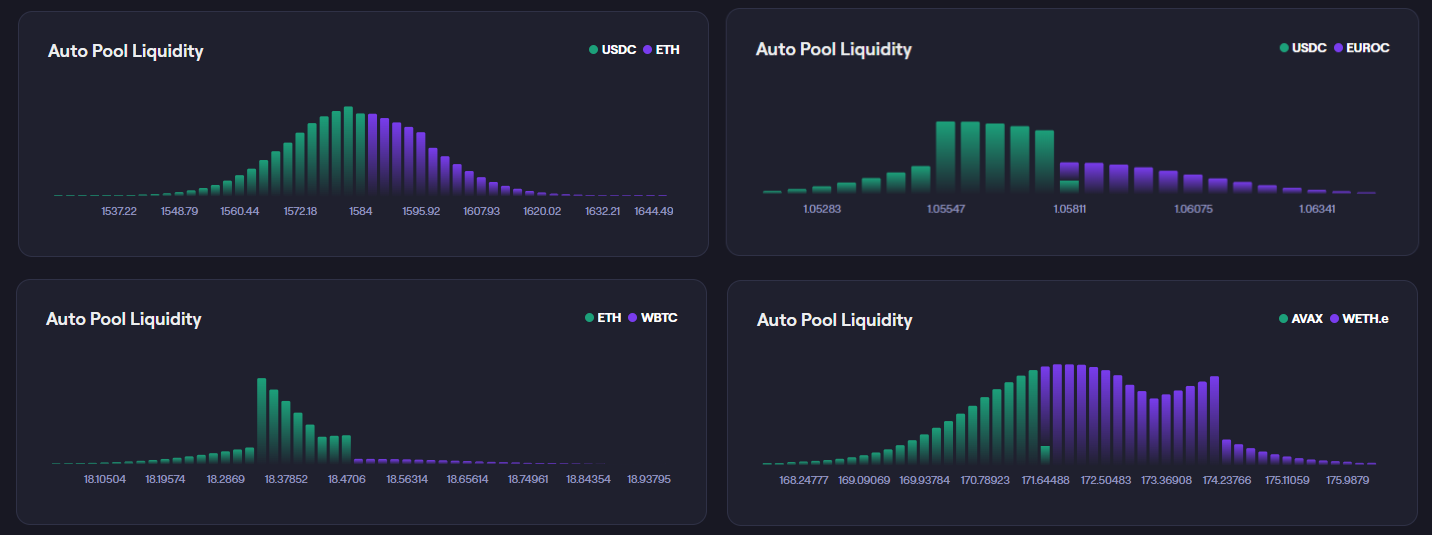

Users deposit Liquidity into an Vault. The Vault will then automatically execute the process of rebalancing the liquidity within a Liquidity Book pool. You can think of the Vault as an algorithmic Liquidity Provider. The algorithm aims to maximise fee generation and it will do that by assessing conditions within the Liquidity Pool and balancing liquidity accordingly to ensure fees are being earned. You will see a variety of shapes and distributions which are decided and executed exclusively by the algorithm.

How to Withdraw

When the user withdraws from the Vault , they receive back their proportionate share of the current asset composition, with any fees accrued. Withdrawal from an Vault is not instant, as orders to withdraw are collected and then executed on the next rebalance in the Vault. This can be anywhere between instant to 60 minutes.

Withdrawals may be impacted by network congestion, if in such an instance there is heavy congestion preventing transactions from executing, withdrawals can take longer.

Vault Infrastructure

With current popular solutions in the field of automated liquidity management, strategies are typically executed via a smart contract. Vaults however have been built differently and are instead executed by an off-chain hosted command centre. This allows for Vault and the underlying algorithms to be dynamically updated and iterated on over time to optimise the balancing process and improve performance.

Liquidity Book uses RedStone price feeds for pricing assets in Vaults.

⚠️ Disclaimers

Despite the inherent liquidity and contract risks associated with delegating liquidity from the Vault to the execution vehicle, automated rebalancing will be limited to eg hourly or daily. To further minimize risks, Vault may have further restrictions applied to them on the actions that can be taken for liquidity management. This would also allow for easy integration of 3rd party operators onto the platform.

It is important to highlight that Vault are not a product that offers ‘staking’ and that Vaults do come with risk. Vaults are not ‘Impermanent Loss’ proof and they are not an ‘investment vehicle’. Vaults carry token price risk, just like any form of providing liquidity.