Adding / Removing Liquidity

How to add Liquidity to a Pool?

Go to the Pools page

Find your prefered liquidity pool, this will depend on the tokens you hold

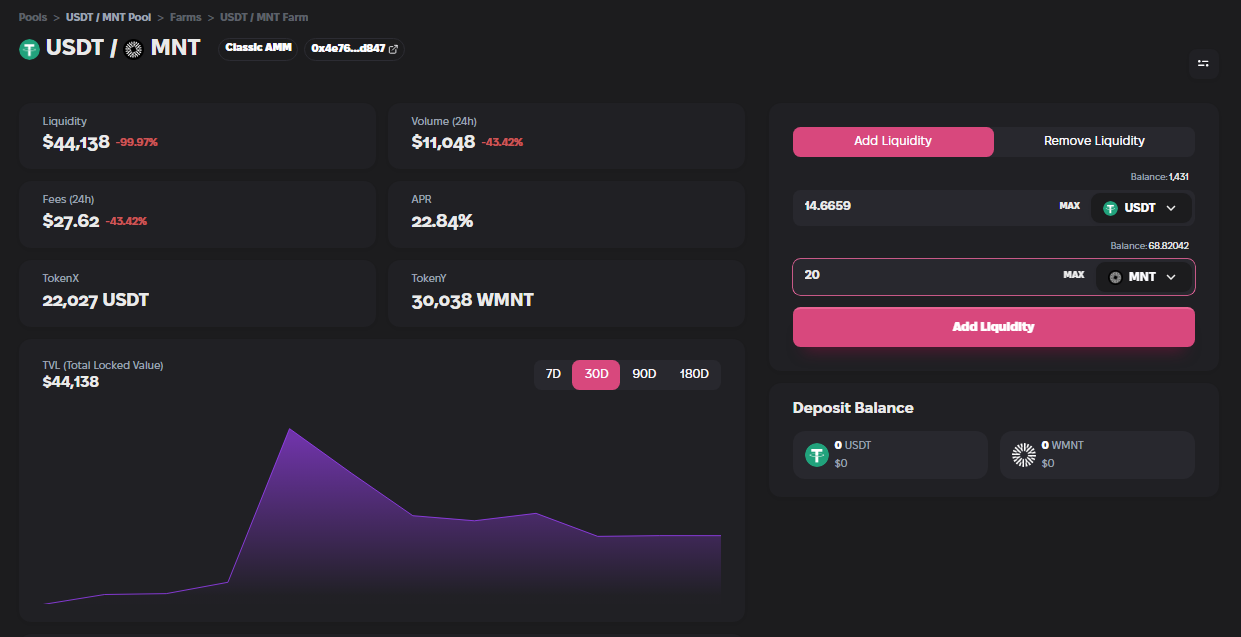

Click into the Pool to enter the Pool page (image below)

Add your Tokens by selecting quantities, this will need to be a perfect 50/50 ratio

Click Approve/Confirm to initiate the Transaction in your Wallet

Done! You are now earning your share of Trading Fees generated by the Pool!

When you deposit tokens into a pool, you receive a LP Token. This token may be eligible for use in our farming programs to earn additional yields, such as $MOE tokens, on top of the trading fees.

How to Remove Liquidity from a Pool?

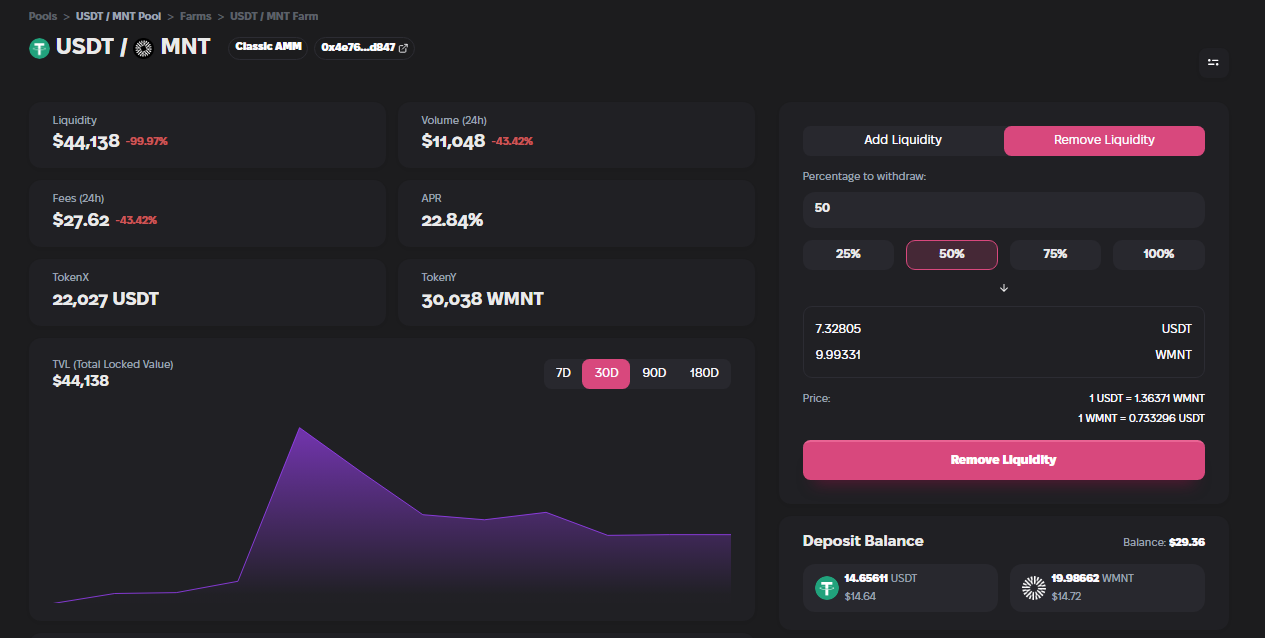

To withdraw, navigate to the desired pool and select 'Remove Liquidity'. Input the tokens you wish to withdraw or choose a preset percentage. The system will automatically calculate the necessary token ratio.

After selecting the withdrawal amount, you will need to approve the transaction in order to remove the tokens. Your wallet will prompt you for confirmation, and upon completion, your tokens will be returned to your wallet.

Impermanent Loss (IL)

Providing Liquidity comes with a risk of Impermanent loss. This occurs when you provide liquidity to a pool containing two different assets in equal value.

What is Impermanent Loss?

When you deposit assets in a liquidity pool, their ratio is set at 50/50.

If the price of one asset changes compared to when you deposited, the ratio of assets in the pool changes to maintain a balance.

This can lead to 'impermanent loss' because the value of your deposited assets may become less than if you had just held onto them separately.

Impermanent Loss is not permanent and it can be reversed if more fees are earned on the position

Impermanent Loss is only permanent, when you withdraw from a Liquidity Book, you are essentially crystallizing those losses.

Your Risk as a Liquidity Provider

Price Volatility: The greater the price change of one asset relative to the other, the larger the potential impermanent loss. This is a significant risk in volatile markets.

Opportunity Cost: You might lose out on potential gains you could have had if you simply held the assets outside the pool.

Temporary Nature: The loss is 'impermanent' because it only realizes if you withdraw your assets from the pool. If prices return to their original levels when you entered the pool, the loss can be reversed.

Dependent on Pool Dynamics: The extent of impermanent loss depends on the specific dynamics and rules of the liquidity pool you're participating in.