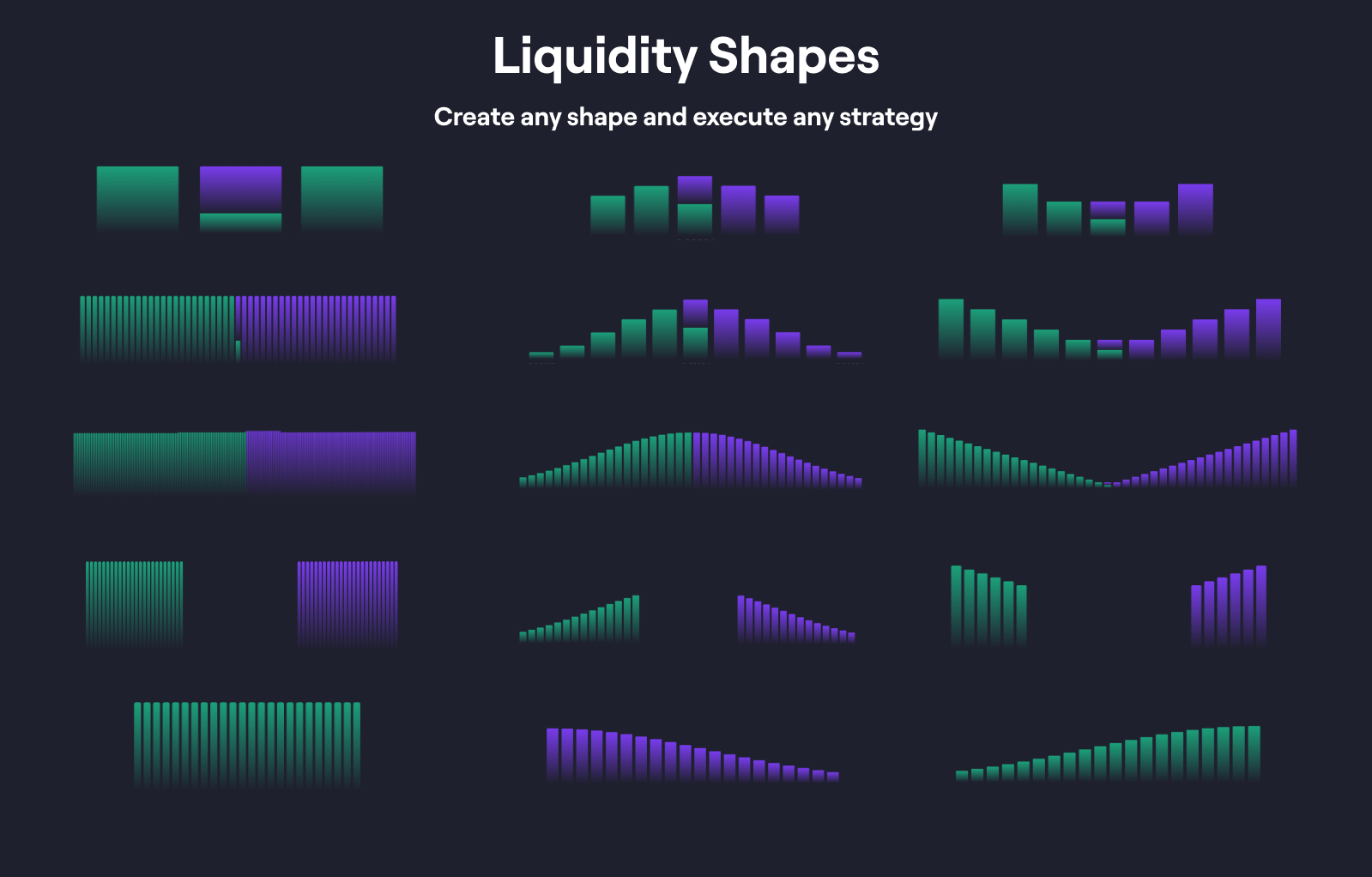

Complex Strategies

Using Liquidity Book you can create and deploy any type of shape you desire to execute your perfect liquidity strategy. Below are some examples of more advanced strategies that can be executed using the most customizable and versatile AMM in DeFi.

Ranged Limit Orders

Multiple Spot Limit Orders can be deployed at specified intervals to scale in or out of the position at important price points.

This Shape is the most suitable for active liquidity providers, who are more interested in trading tokens rather than earning passive fees from volume.

De-peg Bets

Not all stablecoins are always stable, and two Spot Shapes can be combined to catch any potential depeg and earn some fees while doing so. As most people provide liquidity only at the peg, this shape can generate a disproportionate fee if the bet is correct.

This shape can be deployed as regular liquidity to capture continuous volatility around the specific price point or as a combination of one-time limit orders if any potential depeg is expected to be short-lived.

DCA and Earn

One of the significant advantages of Liquidity Book’s flexibility is its ability to allow users to easily DCA. Liquidity providers can combine Bid-Ask, Spot, and Curve shapes to create strategies that perfectly suit them.

A limit order to start buying if the price hits a specific point can be combined with a wide-range spot liquidity for passive fee income.

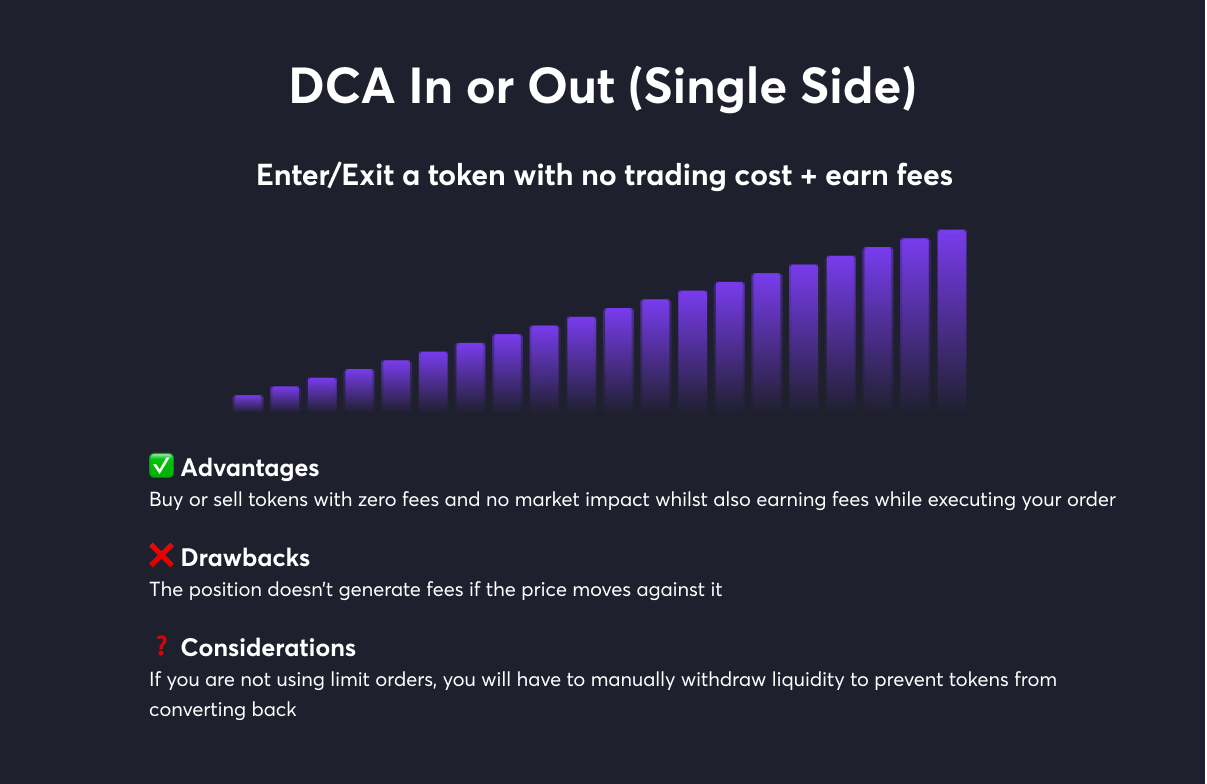

Dollar Cost Average In/Out (DCA)

DCA Shapes can be perfect for those who want to acquire large amounts of tokens with zero slippage or simply prefer to exit or enter their positions while being paid. A one-sided Curve or Bid-Ask shape can be deployed alone or in combination with other strategies to achieve the desired Average Cost. If preferable, liquidity can be deployed as a limit order so that tokens are withdrawn from liquidity once the conversion is complete.

Buy or Sell Walls

Using a Spot shape on one side of the pair can allow liquidity providers to create a Buy or Sell Wall. This Shape can be used at support or resistance lines to maximize fee acquisition. This shape can also serve as a unidirectional bet on a depeg or a variation of the DCA strategy.

Liquidity Walls can be used by individuals but also by protocols who are looking to ensure the minimum price wall for their native token and perform “automated” buybacks when the price dips.

Your Risks

Engaging in providing Liquidity using the Liquidity Book protocol involves risks, including but not limited to impermanent loss, smart contract vulnerabilities, systemic failures, liquidity crunches, regulatory changes, market volatility, and operational errors. Your capital is at risk; only invest funds you can afford to lose. No assurance or guarantee is provided, and LPs assume all responsibility for their investments. Seek independent financial advice as needed.