Staking

The MOE Token governs the Merchant Moe protocol. Staking MOE tokens offers users the chance to participate in both protocol revenue sharing and governance. Staking is unified in Merchant Moe, meaning users will accrue both voting power (veMOE) and real yield (sMOE) simultaneously while staked.

MOE staking is highly accessible. Users may stake MOE tokens at any time.

No deposit or withdrawal fee

May stake or unstake any time

Grants access to sMOE revenue sharing

Also accrues veMOE, for emissions governance

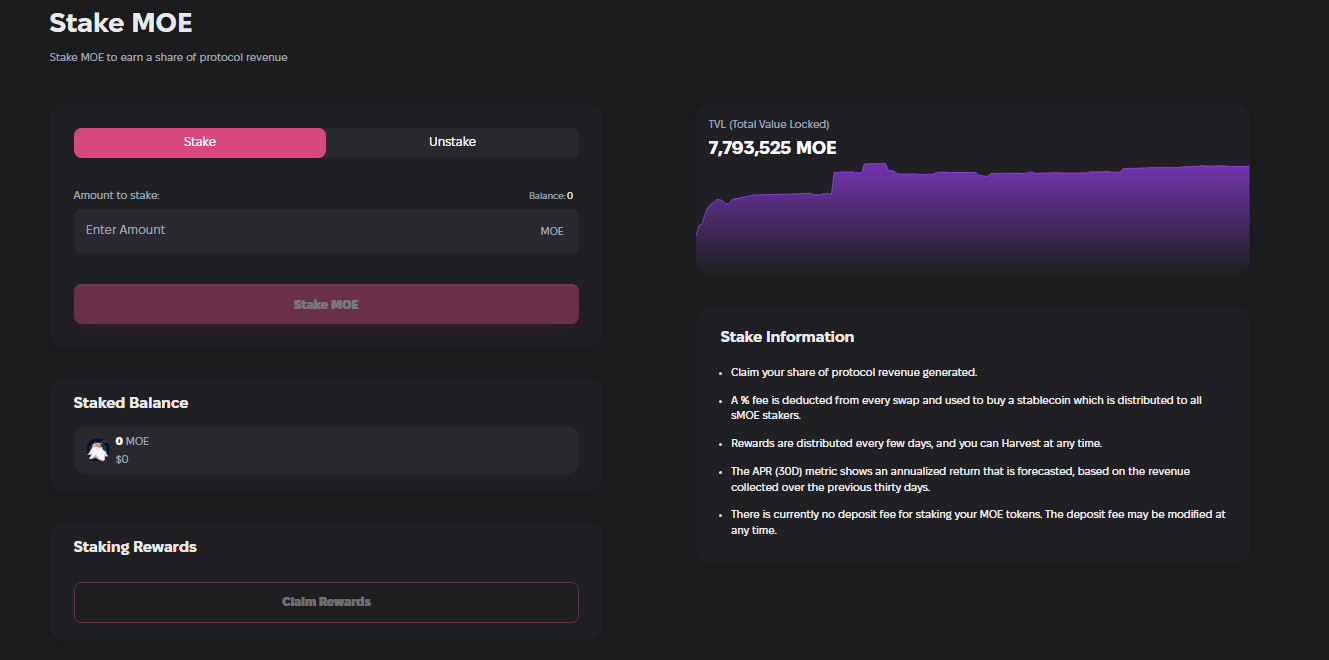

How to Stake MOE

Go to the Stake Page

Select the MOE Staking Pool

Deposit your MOE Tokens

Confirm any Wallet Transactions

Congratulations, you are now Staking!

💡 Staked MOE has no receipt token.

sMOE: Revenue Sharing

sMOE is a staking product that provides users with a non-dilutive real yield. Unlike other staking products that may dilute value by issuing more tokens, sMOE's yield is derived exclusively from the trading fees generated by the platform.

These trading fees are collected every 1-3 days, swapped to $MOE token, and distributed to MOE stakers, proportionally to their staked MOE balance. To claim your rewards, simply click “Claim Rewards” and confirm any wallet transactions.

The distributed token for protocol revenue sharing is subject to change. Since launch, Merchant Moe has has only changed the distribution token once, switching from $mETH buybacks to $MOE buybacks as a part of Tokenomics V1.5. Read the full details here.

Earn your share of Platform Trading Fees

Each transaction on Merchant Moe incurs a fee, which is then allocated to liquidity providers and to the protocol. For all trades routed through Moe Classic AMM pools, a fee of 0.3% is taken. That fee is split, with 0.25% going to LPs and 0.05% to the protocol.

Fees vary for Liquidity Book pools, starting at 0.02% for stablecoin pairs like USDT-USDC and can escalate up to 0.8% for certain pools. In volatile trading conditions, fees can peak at 2.48% due to 'Surge Pricing.' For a detailed explanation of Surge Pricing, please refer to the Merchant Moe documentation.

Protocol Fees (Liquidity Book Pools)

sMOE holders benefit from a portion of the fees collected by the protocol. The share of protocol fees varies by market type:

Stablecoin pairs 0-5%

Alt stables / Staked 10-25%

Majors / Network Tokens 10%

Altcoins 15-20%

Long-Tail 25%

You can check the exact protocol fee for any liquidity pool in the Analytics section. For instance, a 25% protocol fee indicates that a quarter of all fees generated by the pool are distributed to sMOE holders.

💡 The final fee share rate of each market is subject to change and the Core Team reserves the right and has the discretion to adjust fee share rates to ensure efficiency and optimization for all users.

Example of fees accrued:

A $100 USDC swap into MOE will charge a $0.2 fee because it is a 0.2% bps pool

MOE is a “Major / Network Token” - 10% of the fees will be deducted for sMOE

$0.2 x 0.1 = $0.02

Therefore $0.02 will be converted into USDC and added to the sMOE

Staking into sMOE rewards you with a share of all platform revenue generated depending on your share of the staking pool. Your share of the pool is determined by how many MOE tokens you have staked into the sMOE pool.

How much can I earn?

sMOE Stakers receive rewards proportional to their share of the sMOE vault.

Rewards are variable and based on trading fees accrued on the platform, more trading volume will result in more fees captured

💡 Calculation: userRewardRate = userMoe / totalMoe * sMoeRewardRate.

Topping Up

You can top up your existing staked amount of MOE to increase your share of rewards

When you top up your MOE Tokens with more MOE Tokens, you will automatically claim any pending rewards you may have

Claimed rewards automatically enter your Wallet

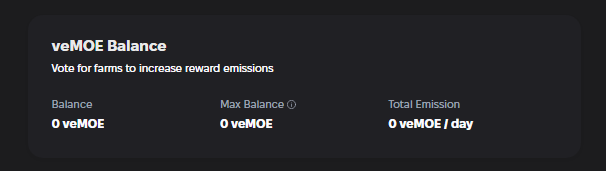

veMOE: Emissions Governance

Merchant Moe distributes a large portion of its token supply via Liquidity Mining. The designation and allocation weights are governed via veMOE.

veMOE is non-transferable token accrued by MOE stakers which represents their voting power within the protocol. Users can influence MOE rewards by voting to increase emissions weighting directed at various liquidity pools. This system also incorporates a feature where users can earn extra tokens (Voting Rewards) by voting for certain pools that have been incentivized with extra tokens.

For more information on the voting mechanism of veMOE, please read the Gauges & Voting Rewards section of our documentation.

veMOE Accrual

MOE stakers accrue veMOE while staked.

Maximum veMOE: The maximum quantity of veMOE you can accrue is equal to 1000 times the staked MOE balance.

Accrual Rate: Your veMOE balance is accrued at a linear rate, and reaches the maximum veMOE in 7 days.

Unstaking: If a user unstakes any of their MOE balance, their veMOE balance is set to zero

Topping Up: If a user increases their MOE staking balance, their veMOE balance remains unchanged, but the maximum is increased. You will begin to accrue veMOE for the newly deposited MOE at a linear rate over 7 days.

💡 The rate of veMOE accrual may be modified by the team. This may be governed by community governance in the future.

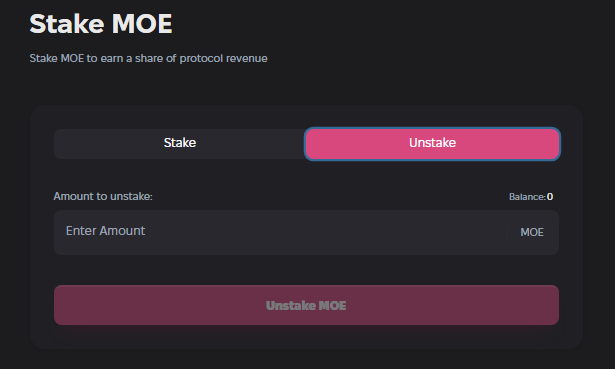

Unstaking MOE

MOE can be unstaked at any time with no fee.

If you wish to unstake your MOE, you will first need to remove any votes you actively placed with your veMOE. Only after removing these votes will you be able to unstake your MOE tokens.

It is important to note that unstaking any amount of MOE will result in the loss of all accrued veMOE. Please read the Gauges & Voting Rewards section of our documentation for more details.