How to Earn Fees and Rebalance Your Position

Earning Fees: The Active Bin

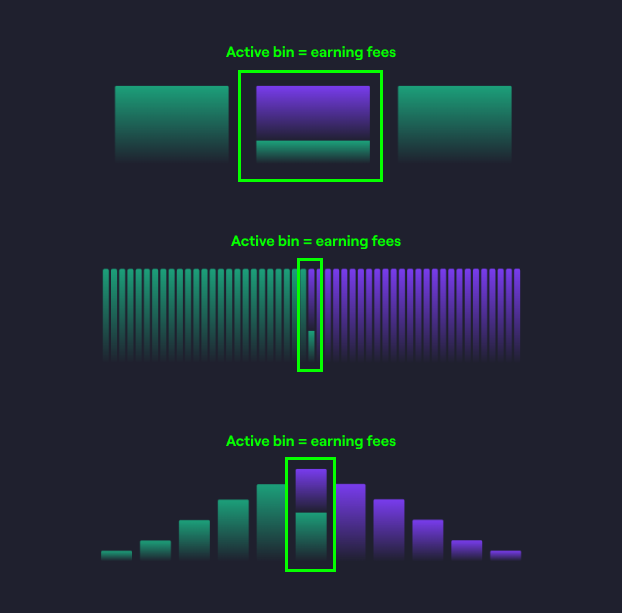

The primary goal for any Liquidity Provider is to accumulate fees generated from the trading activities within a Liquidity Pool. To successfully earn fees through the Liquidity Book, it's essential that your liquidity stays within the designated range. When your liquidity is correctly positioned, the 'active bin' will be visible, depicted on the User Interface (UI) as divided by two distinct colors. Refer to the image below for a clearer understanding of how the 'active bin' is presented on the UI.

Maximizing your fee earnings requires active management of your liquidity. This involves maintaining its balance and ensuring it remains within the set range. The shapes of liquidity and the strategies you implement for managing your liquidity are critical factors in your ability to generate fees.

Your Liquidity is 'Out of position'

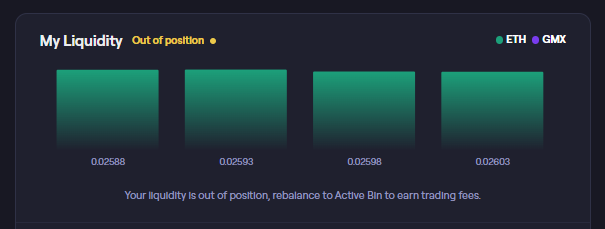

As the asset prices in the liquidity pool fluctuate, your liquidity position might become 'out of position'. This indicates that the liquidity you initially deposited within your selected range no longer aligns with the current market price of the assets. The example below demonstrates how the User Interface (UI) will signal this shift in your position. Depending on the direction of the price movement, your liquidity display will be either entirely green or purple. An 'out of position' alert will be visible.

When this alert appears, it means you're no longer accruing fees from your position, and it's time for you to consider what actions to take next.

What should I do when my Liquidity is out of position?

Here are scenarios that explore the possible actions an LP might consider when remedy an out of position range:

Scenario:

Assume you, as an LP, have provided liquidity to a pool for the ETH/USDC pair, placing your liquidity in the price range of $3,000 to $3,500 per ETH.

The current price of ETH is $3,200, so your liquidity is active, and you're earning fees from trades occurring within your range.

The market shifts, and the price of ETH rises to $3,600 due to a bullish trend, moving your liquidity out of range.

Your Decisions to make:

Do Nothing (Passive Management):

You could choose to do nothing, leaving your liquidity out of range.

Pros:

Avoid transaction fees (gas costs) associated with rebalancing or repositioning.

If the price comes back into your range, you'll automatically begin to earn fees again without any action required.

Cons:

You won't earn fees while the price is out of your selected range.

If the price continues to rise, your position will increasingly consist of more USDC and less ETH, which may not be optimal if you believe ETH's price will keep rising.

Reposition Liquidity (Active Management):

You might decide to move your liquidity to a higher range, say $3,500 to $4,000. To do this must withdraw your liquidity and re-deposit it. When doing that you may need to swap into the other token to deploy with both tokens, or you can redeposit at a new range, with a single-side of the market and wait for a retracement.

Pros:

Begin earning fees again if the price remains within the new range.

Maintain exposure to ETH if you believe the uptrend will continue.

Cons:

Incurs transaction costs, which can be significant on networks like Ethereum.

If the price quickly reverts back to the original range, you might miss out on fees and incur additional costs to move back.

Withdraw and Hold (Exiting the Pool):

Another option is to withdraw your liquidity entirely and either hold the assets or reallocate them elsewhere.

Pros:

No longer subject to potential impermanent loss if you believe ETH will continue to rise.

Flexibility to invest your assets in a different opportunity.

Cons:

No longer earning trading fees from this liquidity pool.

May incur transaction fees and a taxable event upon withdrawal.

Add More Liquidity (Doubling Down):

If you have additional capital, you could choose to add more liquidity at higher price ranges without touching your original position.

Pros:

Potentially earn fees across a broader price range if you expect volatility.

Diversify your positions within the pool.

Cons:

Increases your exposure to the pool, which might not be optimal if the price falls.

Additional capital is tied up in the liquidity pool.

Each of these decisions carries trade-offs and risks, and the best course of action will depend on your own assessment of the market, your risk tolerance, and your goals as a liquidity provider. You must consider factors like market trends, the cost of gas fees, the potential for impermanent loss, and their desire for passive vs. active management when deciding how to manage your liquidity position.

⚠️ Your Risks

Managing concentrated liquidity involves significant risk and is not suitable for all DeFi participants. The nature of concentrated liquidity positions can lead to increased exposure to market volatility, impermanent loss, and other financial risks. This activity should only be undertaken by those who have a comprehensive understanding of decentralized finance (DeFi) protocols and are prepared to accept the possibility of substantial losses, including the potential loss of all invested capital. The information provided here does not constitute investment advice, financial advice, trading advice, or any other sort of advice and should not be treated as such.