Permissionless Liquidity Book Pools

Open a Pool

Navigate to the Pool page and select 'Create New Pool'. You will be presented with two options 'V1' and 'V2'. Select V2 to start your market setup for a Liquidity Book Pool.

What is the difference between V1 and V2?

V1 will establish a Liquidity Pool using the x*y=k Automated Market Maker (AMM) model. This AMM ensures an equal distribution of two token types within the Liquidity Pool (50/50 balance), distributing these assets across a price curve that ranges from $0 to infinity. For those introducing a new token on the DEX, this option is typically the most suitable for a new pool, as the AMM continuously maintains the balance of your tokens.

V2, on the other hand, will set up a Liquidity Book Pool. This type of pool permits liquidity providers to focus their liquidity, thereby substantially enhancing the capital efficiency of their assets. However, it comes with greater risk and responsibility. It requires providers to actively manage their liquidity and ensure it stays within the designated range.

V2: Setting up a Pool

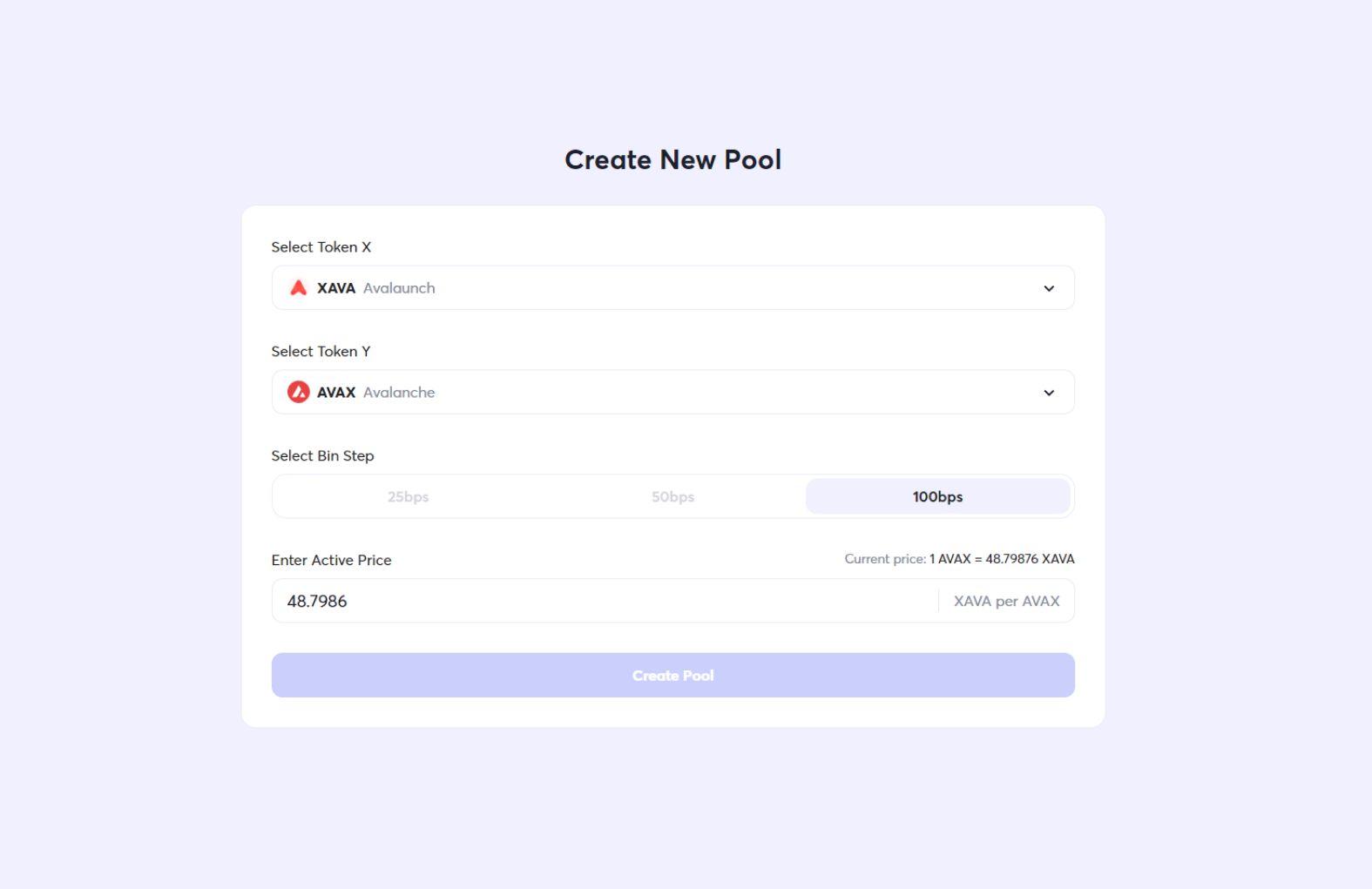

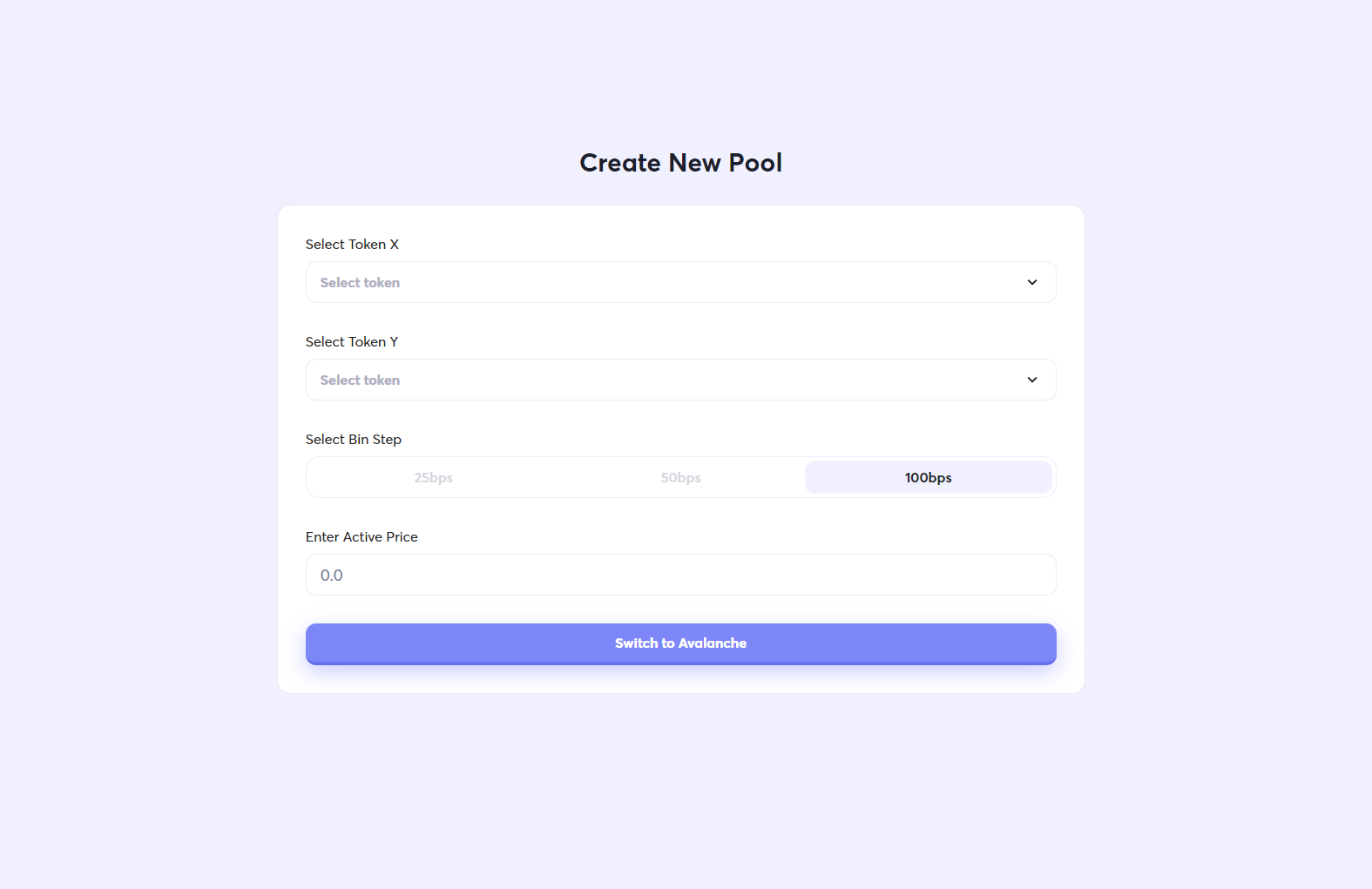

Selecting V2 when you create a new pool will present you with some key options that let you select your chosen Tokens and your Bin Step configuration.

What are Base Assets and Quote Assets?

Token X = Base Asset

Token Y = Quote Asset

The Base Asset can be any token that you decide, this is the token that you are pairing directly with a Quote Asset. The Quote Asset is the Token that is used to price the Base Asset and will only be defined to certain tokens, such as JOE, ETH or USDC.

Quote Assets are restricted to key tokens to ensure liquidity + routing is kept optimal.

What is Bps (Bin Step) and what is best for my pool?

Every Liquidity Pool consists of 'bins,' which serve as containers for liquidity. Each bin corresponds to a specific price point for the pool's assets. These bins, when combined, create a liquidity pool that possesses a comprehensive price curve for its assets. There is a distinct space between each bin, representing the price differential from one bin to the next. This difference in price is known as the 'Bin Step.'

Example of 20bps (0.2%) discretization:

ARB - USDC Bin 1: $1.21464

ARB - USDC Bin 2: $1.21707

Comparison Example:

Liquidity deployed over 20 bins in a 100bps (0.8%) pool will cover a 22% price range whereas liquidity deployed over 20 bins in a 20bps (0.2%) pool which would cover 4% price range.

When setting up a new Liquidity Book Pool for your token, you might want to opt for a pool with greater discretization. This approach can simplify the management of liquidity positions in your pool. This may help Liquidity providers to maintain liquidity within the desired range.

V2: Finalize and Launch your Pool

Once you have defined your Tokens and Bin Step configuration, you are ready to create your pool. The final step before launching is to define the current active market price. This is an important step as entering in the wrong price of your assets will lead to initialization of the Liquidity Book pool with an inaccurate market price that may result in loss of funds.

It's essential to verify the Active Price and confirm that it accurately reflects the market conditions. Inputting an incorrect active price can result in your funds being arbitraged, leading to an irrecoverable loss of funds.