Introduction to Shapes

What exactly is a Liquidity Shape?

Before we dive into strategies, you might be wondering about the term "liquidity shape." In traditional liquidity pools, you would spread your assets evenly across a range of prices. Liquidity Book, however, revolutionizes this process by enabling you to create unique "shapes" of liquidity.

This means you can strategically place varying amounts of your assets at different price levels, effectively creating a liquidity shape that best aligns with your market expectations and investment convictions. There is no right or wrong liquidity shape – each one will perform the best depending on your own management of your position and also market conditions.

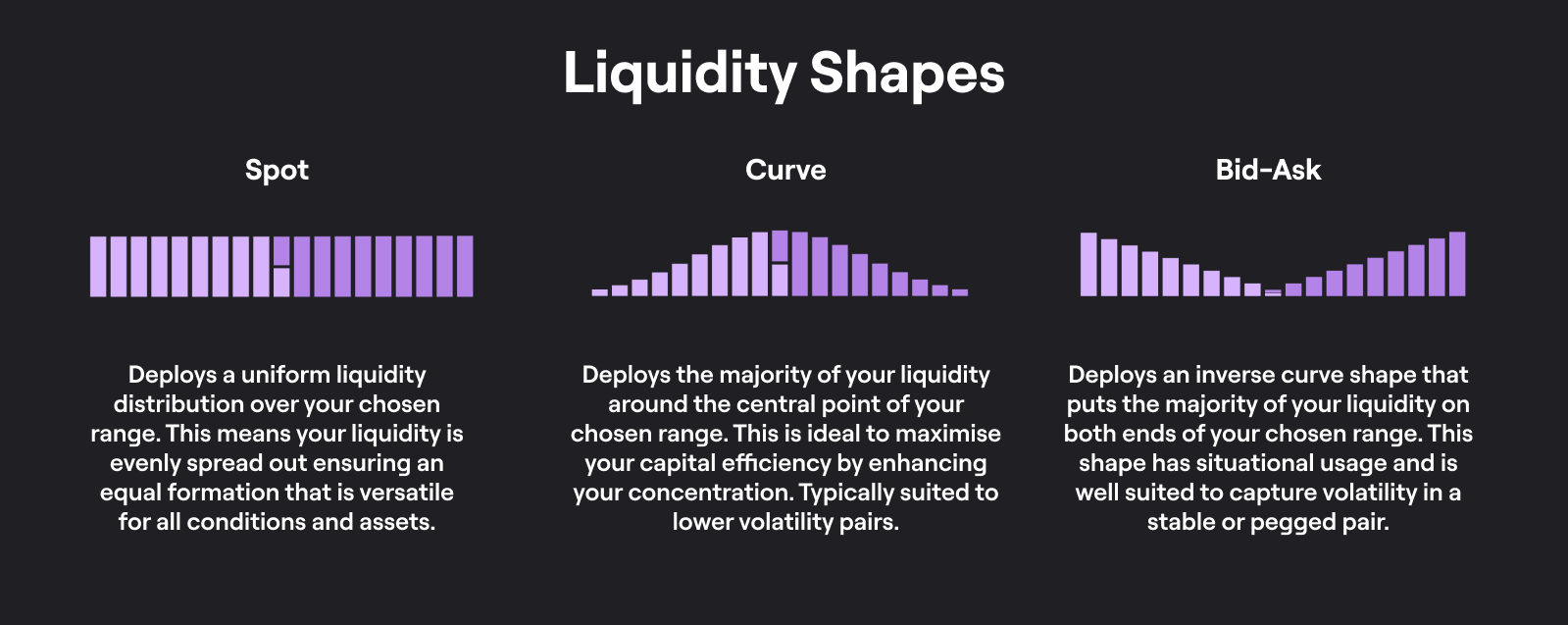

Below is a high level overview of Liquidity Shapes. Each specific bar you see in the liquidity shape is one bin and each bin represents a fixed price point. The below image outlines the three core shapes you can deploy, with an overview detailing the key use-case of each shape.

Please note that providing concentrated liquidity can come with large risk of impermanent loss if a position is not monitored closely. No strategy deployed will prevent the possibility of Impermanent Loss. You must monitor your position.

Learn more about the unique shapes and strategies

We've outlined multiple strategies, ranging from very basic to very advanced strategies that you could implement on Liquidity Book. It is highly recommended that you take time to read this guide to help enhance your understanding of how you can utilize various liquidity shapes, to suit your unique investment strategy with Liquidity Book.

Basic strategies: The most suited for users who are just getting familiar with concentrated liquidity, the Liquidity Book and its bin architecture. They can be deployed in one click using LFJ’s interface and don’t require any advanced knowledge.

Advanced strategies: Combine two or more basic shapes to achieve even more granular control over liquidity. They are more difficult to deploy and carry greater risks but can yield better rewards.

Single side strategies: By deploying just one side of the market, you can execute entry/exit to a specific token on the other side of the market. Utilizing the different shapes available will further enhance your efficiency of how you enter/exit a token.