Guide to Limit Orders

Limit Orders have not yet been implemented on Merchant Moe

What is a Limit Order?

A limit order is a type of trade that executes an automated buy or sell instruction for a token at a specific price. Traders use this when they have a target price in mind and are prepared to wait for the market to match this price.

How are Merchant Moe's Limit Orders Unique?

Merchant Moe will be one of the first Decentralized Exchanges (DEXes) to implement fully on-chain 'maker style' limit orders.

What does 'Maker Style' mean?

Maker-style limit orders are orders that add liquidity to a Liquidity Book Pool. These orders are referred to as "maker" orders because they "make" liquidity by being available for takers to execute against. These limit orders allow traders to set up trades that execute without incurring fees and with no price impact.

Advantages of On-chain 'Maker Style' Limit Orders

No reliance on external oracles

Your trades have perfect execution

Complete decentralized ‘on-chain’ execution

Swaps with no additional fees to pay or price impact on your swap

Liquidity Book doesn't charge any fees on limit orders. Plus, there is no price impact or slippage on swaps when using the limit order feature making it a highly efficient option for trading.

Why won't my Limit Order execute?

For your limit order to complete, it must be fully filled. An order will only fill if there is an equal or greater trading volume corresponding to your order size. For instance, if you place an order to purchase $1k worth of tokens, there needs to be a seller swapping that amount of tokens at your specified price point, to fill your order.

Types of Limit Orders

Merchant Moe offers two types of limit orders that open up new strategies while also offering more flexibility and control for your trading and liquidity providing. These are Place Orders and Pool Orders. Both types of limit orders enable you to automate the execution of your swaps.

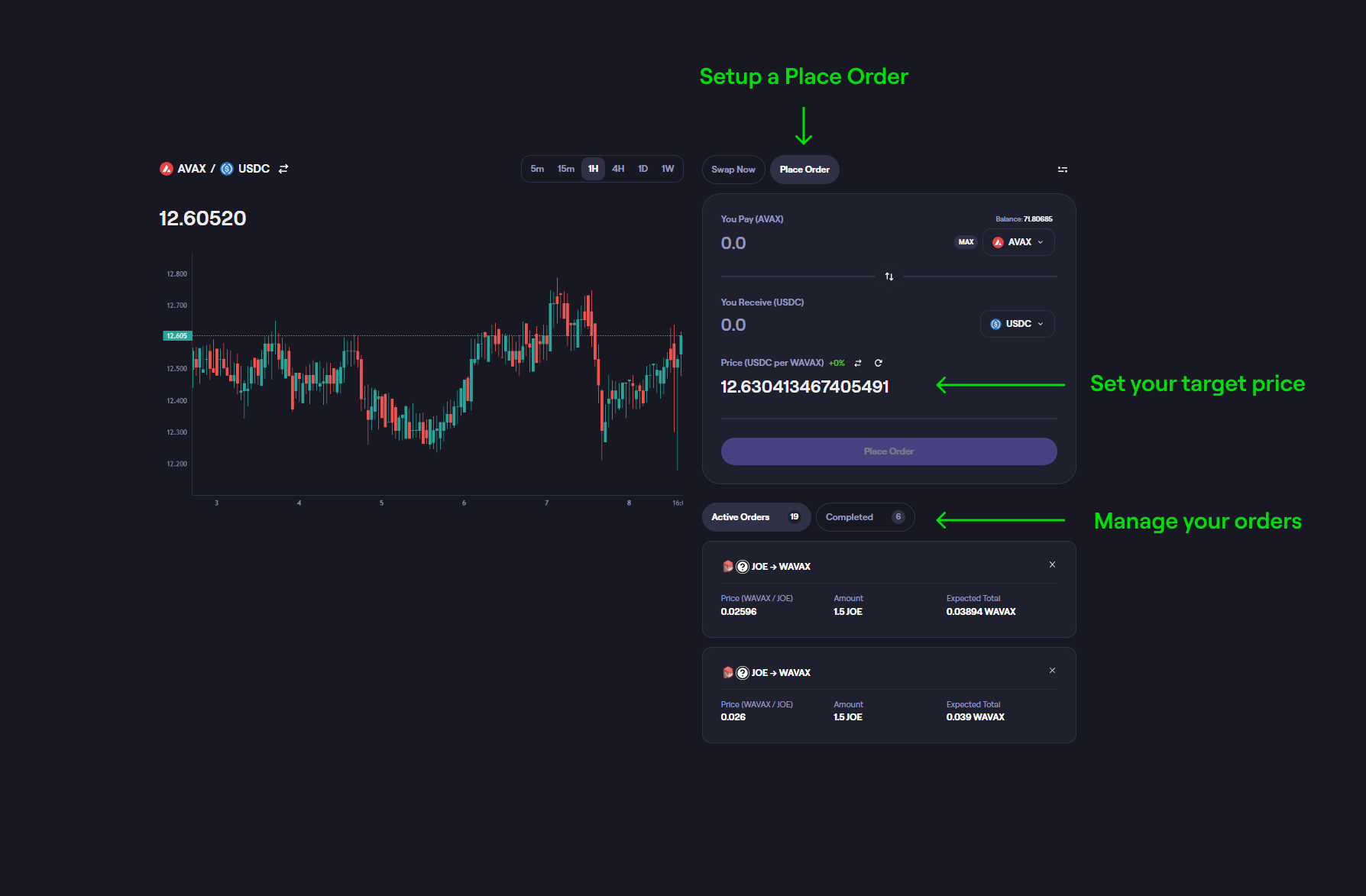

Place Orders

Place Orders are set to trigger at a price you select. When that price is reached, your tokens are automatically moved into a liquidity pool and converted into the tokens you want to acquire. These tokens then await your action to claim them.

Setting up a Place Order

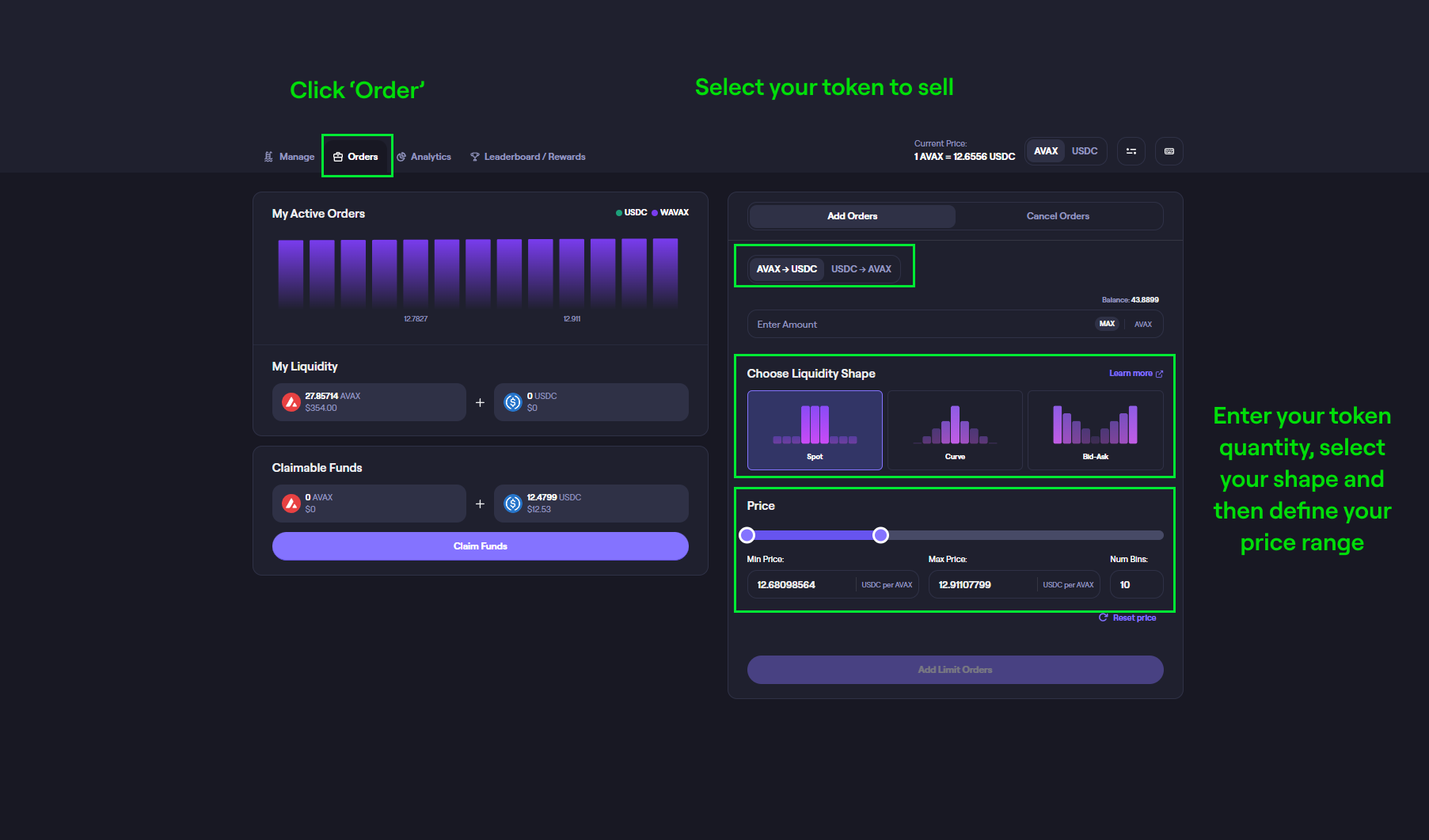

Pool Orders

Using the Pool Order feature, you can deposit liquidity across a specified range, such as $10 to $100. This is different to a Place Order, where you only specify a fixed price point for your order, such as $10. Using a Pool Order, your order is filled gradually as the price of the asset moves inside your range. Pool Orders are an excellent way to automate your Dollar-Cost Averaging (DCA) strategy, to enter or exit a token with no fees or price impact.

How to setup a Pool Order

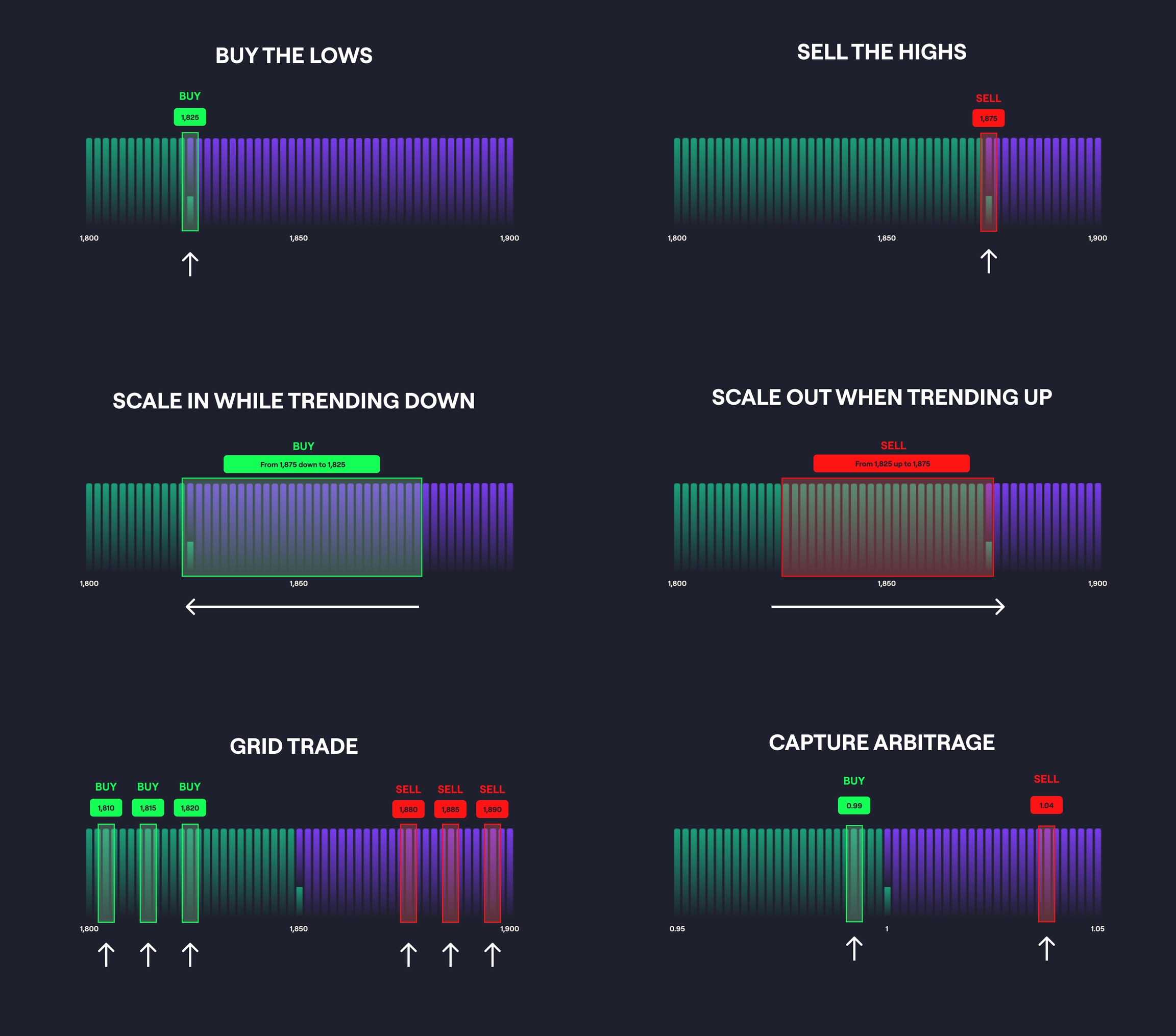

Limit Orders: Strategy Showcase

Use Limit Orders to automated advanced trading strategies: